SPA doesn’t teach financial literacy. Aside from the seniors-only economics history elective, the school curriculum lacks any substantial education on the basics of money and managing finances, something that is required in Minnesota public schools and 25 other states. Although many have their grievances about this, students must do what they can to make up for a lack of organized financial education.

“Money makes the world go round.” In terms of our daily lives, there’s a lot of truth to this proverb. Money provides food, a home, transportation and almost everything material in today’s world. Since relying on school for basic information isn’t an option, students need to take charge of themselves.

High school is the perfect time to start learning about finances. As many students begin to get jobs and credit cards or look at choices for life after high school that involve major financial commitments, financial literacy –the skill of understanding money and finances– is of the utmost importance for high school students. But how does one go about achieving financial literacy?

Asking questions and being curious about money in high school is the best way to set yourself up for success. An easy way to learn more is to talk about the subject with parents and guardians. Admittedly, the ability to do this is greatly influenced by different family situations; a big reason for widening inequality is that wealthier families produce more financially literate adults. Even so, family members and any other close adults are a fantastic place to start.

There are many great resources online as well. For instance, Khan Academy provides free courses on finances and investing, entrepreneur Ramit Sethi has an entertaining and informative show on Netflix called “How to Get Rich” (which, even with the flashy, suspicion-invoking name, actually provides great financial advice applicable to all on “how to live your rich life”) and Bogleheads offers in-depth advice on investing and managing money. With a bit of time and effort, using these resources will help improve financial literacy.

One SPA-specific opportunity is the Investment Club, which teaches about money from the perspective of investing—the science of using money to make more money in a historically low-risk, secure way. Investing is perhaps the most overlooked aspect of finances for high school students. Many people are adept at the simple matter of managing spending (although many people are not, too), but hold trepidation about doing anything more than saving what they don’t spend; they find investing confusing. Let’s break things down.

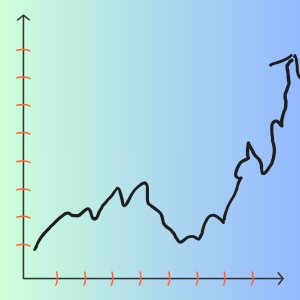

Wealth is driven much more by how much one earns and saves, but achieving a consistently positive rate of return on investments is an advantage everyone should be in on. Aside from the aftermath of the Great Depression, when it took 25 years to recover, the U.S. stock market has never decreased over any (other) ten-year period since its inception, and 75-80% of years have yielded a net increase. Many argue that investing in diversified indexes –a collection of many stocks that aims to mirror the market return by buying everything rather than beat it by selectively investing in specific stocks or industries– is the best way to profit off the stock market.

In the last 50 years, adjusted for inflation, the average annual return of the S&P 500 Index Fund –a collection of the 500 largest publicly traded companies in the United States– is about 8%. And that 8% compounds; if one earns 8% one year, then 8% the next, they will have earned 8% more of what is now 108% of what they started with. After ten years at 8% return, one would have 216% of the original investment–more than double. And the best part? Investing in index funds is super easy.

Take billionaire Warren Buffett’s word for it: “I recommend the S&P 500 index fund and have for a long, long time to people.” Founder of The Vanguard Group (Vanguard), John Bogle, says, “I look at indexing as being simple and, sad to say, boring. Be bored by the process but elated by the outcome. Investing shouldn’t give you a rush.”

Indeed, past success does not assure future success, and the market has been a roller coaster this year, but if history is any indication, it will continue to grow in the long term. Again, the importance of starting early cannot be overstated with investing; starting early is more important than trying to game the perfect entry point into the market. Historically, the easiest way to buy low and sell high is to buy now and wait.

As mentioned before, the most important factor for growing wealth is making and saving money. An excellent way for students to improve their money management skills is to keep track of their expenditures, set goals and create a budget that includes how much they plan to make and how much they want to spend in certain areas.

Another thing that students with jobs should consider is starting a retirement account (sounds crazy, right?). By putting earned income into a Roth IRA, your money is taxed on the way in, but not on the way out (there are requirements about when you can take it out, however, and the usual intent is that this money is left alone for a long time). Once in the account, the money can be invested in a wide variety of ways and is allowed to grow tax-free.

Money doesn’t buy happiness—remember that. But it does dramatically shape lifestyle and can provide flexibility in how you live your life. So, high schoolers, please don’t ignore money and leave everything to parents and guardians. Take some initiative to learn and practice dealing with finances; it will pay off.